epf withdrawal for house

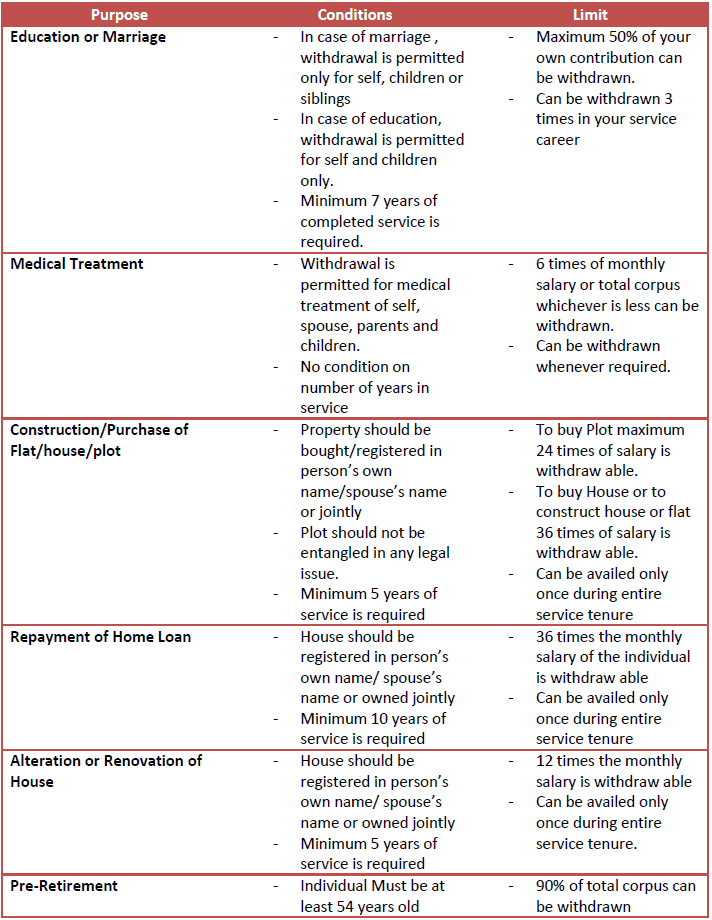

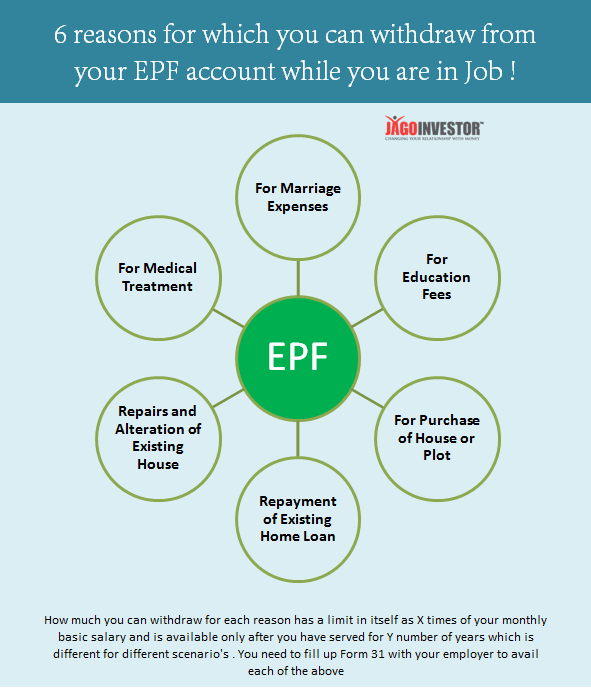

Employees Provident Fund Organisation EPFO enables subscribers to withdraw some part of their fund for various purposes including the construction of a house medical. This withdrawal can only be.

Epf Withdrawal Rules When And For What You May Withdraw Your Epf

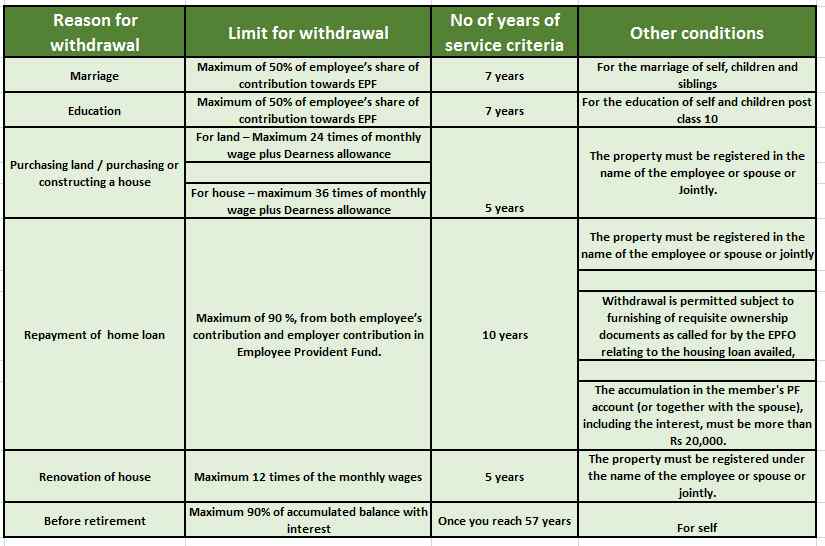

The employee can withdraw from their PF account for making additions or improvements to a residential house that is owned by self or spouse or jointly.

. The maximum that one may withdraw from the PF account is 36 months basic wages or the total of employee and employer share with interest or total cost whichever is least. However if youre unemployed for more than 2 months you can withdraw 75 of your EPF. Some of these include.

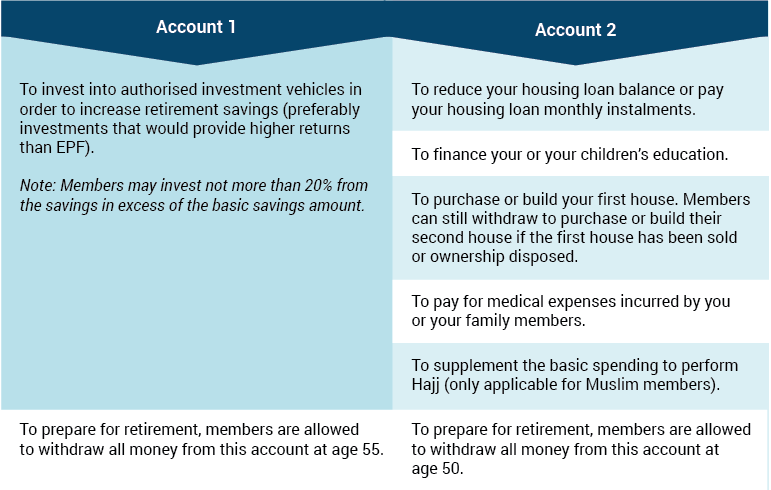

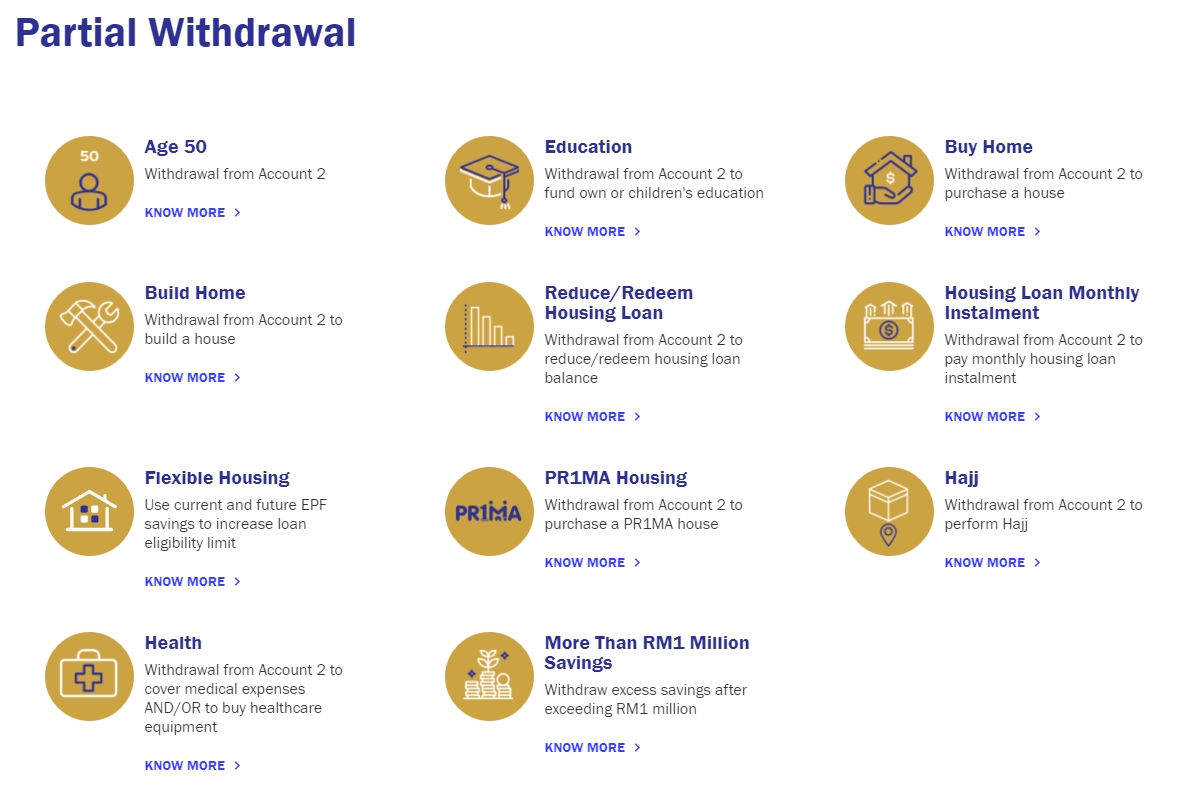

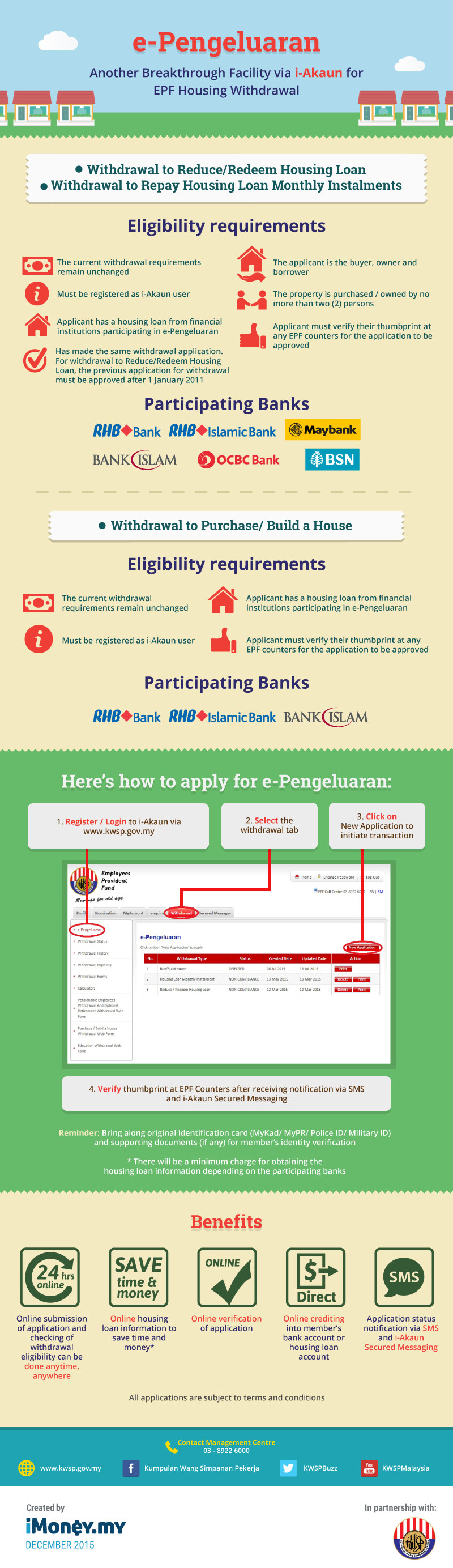

A Malaysian Citizen or Malaysian Citizen who. Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the. Section 68BC of the EPF Scheme allows any member of the cooperative housing society or registered housing society having at least 10 members to withdraw the EPF.

EPF is a retirement savings plan and you can withdraw it only after retirement. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement. This is my 1st property while its 2nd property for my gfWe would like to withdraw.

My gf and I bought a house with bank loan and SP under both of our names. An individual can avail this facility 2 times once after 5 years of completing the residential property and after 10 years can withdraw PF amount for the first time. If the withdrawal is to purchase for second house the first house must be sold or the disposal of ownership of the first property has taken place.

Under its Flexible Housing Withdrawal facility you can apply to EPF to set aside a certain amount of money from your monthly contributions into a special Flexible Housing. Partial withdrawal of EPF is permitted only in the case of a medical emergency house purchase or construction or higher education EPFO allows withdrawal of 90 of the amount 1. Before withdrawing money from your Employees Provident Fund EPF account to pay off your home loan there are certain aspects you need to consider.

Online EPF withdrawal requests can be settled within 15 to 20 working days from the date of submitting the request. While it is possible to withdraw the EPF corpus before. You can withdraw up to 90 of EPF balance employee share and contribution of employer including interest or the construction cost of property whichever is less.

Ease Your Home Loan With Epf Finposts Com

Blended Retirement System Brs Ft Hamilton Us Army Mwr

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

6 Reasons For Which You Can Withdraw Money From Your Epf Account

I Lestari How To Withdraw Rm500 Month From Your Epf Account Soyacincau

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Importance Of Epf Free Essay Example

How To Withdraw Epf Online Indianmoney

Provident Fund Pf Withdrawal Process Bion Advisors

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

What You Need To Know If You Are Planning To Withdraw Your Epf Money To Buy A House The Economic Times

How To Use Epf Account 2 Money To Buy A House Iproperty Com My

024 How To Use Epf Account To Obtain A Higher Housing Loan Amount Youtube

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

60 12 6638425 Epf Withdrawal To Purchase A House

Housing Withdrawals At Your Fingertips Imoney

Real Property In Malaysia Withdrawal Of Epf Savings For House Purchase Revised Requirement Starting 1st January 2017

Comments

Post a Comment